Unifying multiple software products – and an entire team – with a streamlined financial advisory platform.

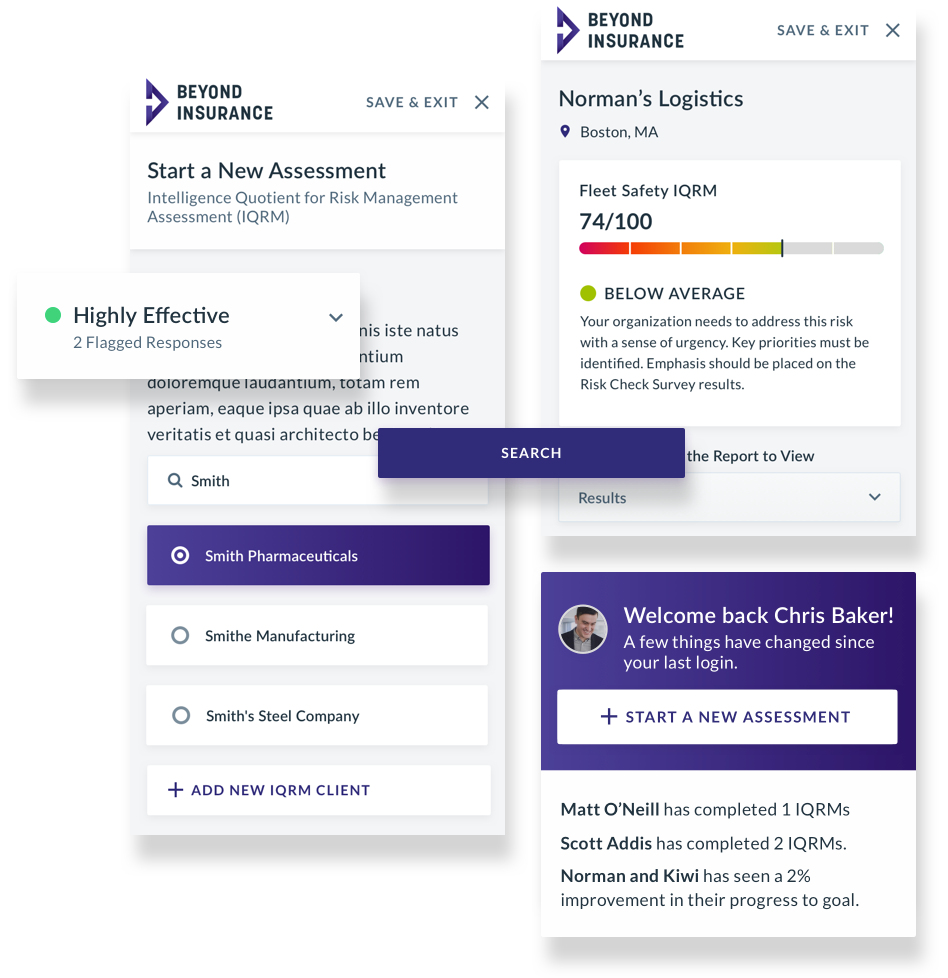

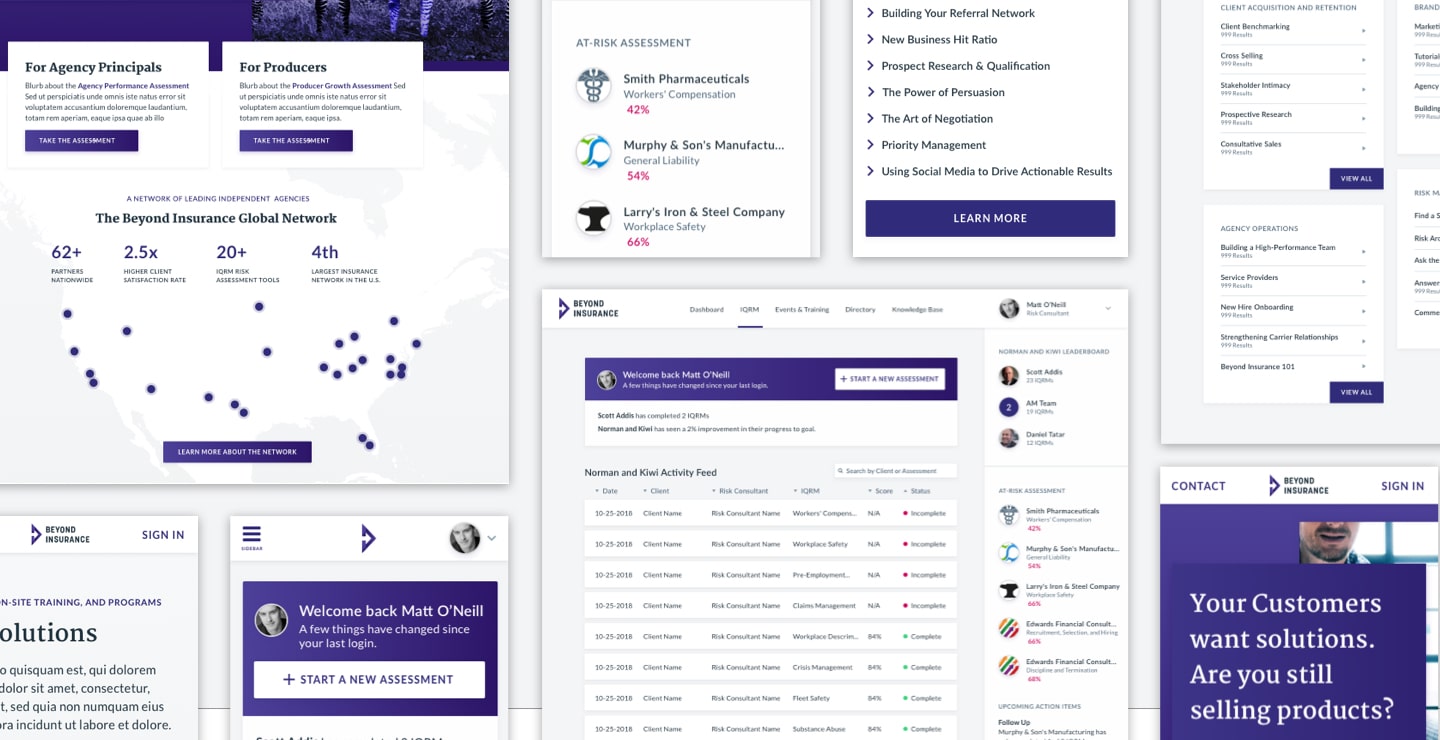

Financial advisors at Broadridge were using multiple software interfaces to manage client accounts, which made it difficult to navigate information and quickly gain insights. So ADK developed a prototype solution for a unified user interface with a streamlined and more effective user experience.